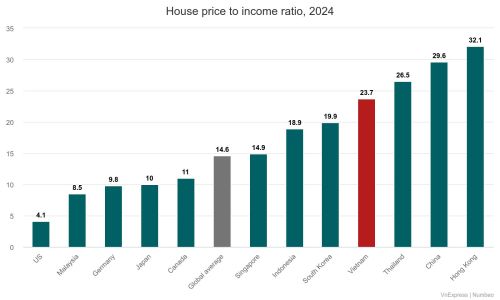

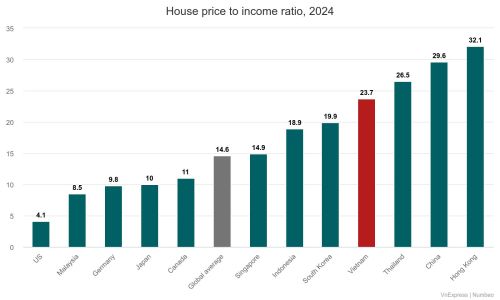

The ratio of housing prices to household income was 23.7 last year, 1.6 times the global average, making housing inaccessible to many, an analyst has said.

The figure, provided by cost of living data research company Numbeo, rose by 0.2 percentage points last year, while the global average dropped by half a point to 14.6, economist Can Van Luc said at a forum Wednesday.

The house to income ratio is recommended by the World Bank and UN to measure the affordability of residential properties.

Luc said the high ratio makes prospective buyers reluctant to approach banks for mortgages, worrying about their ability to repay.

The growth in credit for property development last year was 18%, almost three times that of mortgages (6.5%).

Luc attributed the rising housing prices to several factors like legal issues that delay licenses and high land prices.

Nguyen Quoc Hiep, chairman of investment company GP Invest, said localities are not consistent in land price valuation, which delays acquisition by developers, sometimes by up to two years.

Le Van Binh, deputy director of the Ministry of Natural Resources and Environment’s land department, said there are shortcomings in land price valuation.

Some local officials are worried about making inaccurate valuations for which they could be held legally responsible, he pointed out.

Luc said meanwhile social housing supply remains below demand and speculators push up land prices.

He wondered whether the lack of high taxes on properties contributed to the price surge.

Leave a Reply